Starting a business can be a thrilling adventure, but for many aspiring entrepreneurs, securing the necessary funding often poses a significant challenge. While seeking external investors can be a viable option, it’s not the only path to kickstart your dream venture. Bootstrap financing is a powerful approach that empowers entrepreneurs to self-fund their startups, offering them more control, independence, and the joy of seeing their vision unfold without dilution.

Contents

- Introduction to Startup Funding and Bootstrapping

- The Appeal of Bootstrap Financing

- Personal Savings: The Initial Go-To

- Crowdfunding: Harnessing the Power of the Masses

- Pre-Sales and Early-Bird Specials

- Microloans and Peer-to-Peer Lending

- Trade Equity for Services

- Competitions and Grants

- Leverage Assets: Home Equity and Personal Assets

- References

Introduction to Startup Funding and Bootstrapping

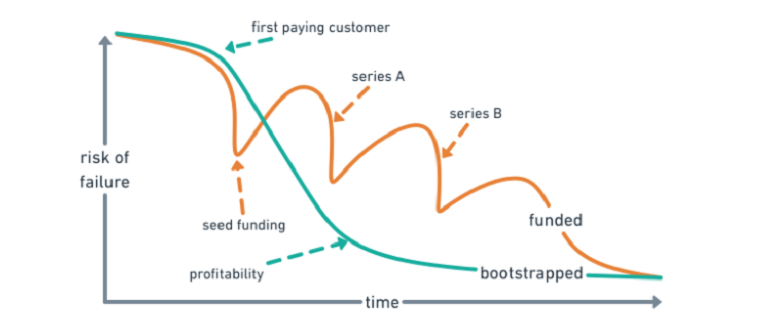

The entrepreneurial journey is often likened to a roller coaster, filled with exhilarating highs, nerve-wracking lows, and twists that can lead to the unexpected. One of the most daunting challenges faced by those dreaming of launching their own venture is funding. Investors, though helpful, can sometimes come with strings attached—strings that might change the course of your dream project. But what if you could navigate this journey on your own terms, free from external pressures? Enter bootstrap financing.

Definition of Bootstrapping

Bootstrapping, in the business world, refers to starting and growing a company using only personal finances or the business’s operating revenue. Unlike venture capital or angel investments, where equity is traded for financial support, bootstrapping relies on the founder’s savings, grit, and resourcefulness.

Importance of Self-Funding and Independence

Choosing to self-fund a business venture is not just about financial decisions; it’s about autonomy. When entrepreneurs bootstrap, they maintain complete control over their business’s direction, culture, and decisions. There’s a profound sense of ownership, not just of the company’s equity but of its essence and ethos. Moreover, without the need to cater to external stakeholders, businesses can evolve organically, pivoting and adapting based on genuine needs and insights rather than investor demands [1].

The Appeal of Bootstrap Financing

The allure of external investors, with their deep pockets and expansive networks, can be hard to resist for many budding entrepreneurs. However, there’s a unique charm and a host of benefits associated with bootstrap financing that make it a compelling choice for many.

Freedom to Make Decisions

One of the most significant advantages of bootstrapping is the unbridled freedom it affords. When you’re the sole funder, you’re also the primary decision-maker. There’s no need to consult with investors or adjust strategies to appease external stakeholders. This liberty allows startups to stay agile, making swift decisions based on market needs and personal business insights. It’s the kind of fluidity that often gives bootstrapped startups a competitive edge in fast-evolving industries.

No Pressure from External Investors

Investor-driven funding can sometimes come with stringent expectations. Monthly or quarterly reviews, pressure to hit certain milestones, or even demands to pivot the product or service can become a regular feature. Bootstrapping eliminates these external pressures. Entrepreneurs can focus on organic growth, prioritize long-term success over short-term gains, and navigate the entrepreneurial journey at a pace that suits the business’s authentic needs.

Building a Resilient, Self-Sufficient Business

Bootstrap financing often forces entrepreneurs to adopt a lean approach, making do with limited resources and budget constraints. While challenging, this very environment fosters creativity, innovation, and resilience. Such businesses learn early on how to maximize ROI, minimize wastage, and operate efficiently. This foundation not only helps them weather initial storms but often sets them up for long-term sustainability and success.

Retaining Full Ownership of Your Startup

Equity is precious. Every time you part with a piece of your company’s equity in exchange for investment, you give away a piece of your business’s future potential. Bootstrapping allows founders to retain 100% ownership, ensuring that when success does come, it’s they who reap the full rewards of their hard work, dedication, and vision.

Personal Savings: The Initial Go-To

Venturing into the world of entrepreneurship with a vision to bootstrap? Your first port of call will likely be your personal savings. Many successful entrepreneurs started their journey with a modest savings account, carefully accumulated over the years. While it might feel daunting to invest your hard-earned money into a startup, it’s this very commitment that can lay a sturdy foundation.

Value of Having a Financial Cushion

Before delving into the nitty-gritty of spending, it’s essential to understand the immense value of a financial safety net. Personal savings provide more than just startup capital. They offer peace of mind. When an entrepreneur knows they have funds to fall back on, they can make business decisions with greater clarity, free from the immediate stress of financial survival. This cushion, no matter how modest, can fuel risk-taking, innovation, and resilience in the tumultuous initial months of a startup’s life [2].

Tips for Saving: Cutting Personal Expenses and Living Frugally

Building a savings pool doesn’t happen overnight. For many, it requires months or even years of careful financial planning and discipline. Here are some steps to consider:

- Budget Meticulously: Keep track of every penny spent. Adopting tools or apps like Mint or YNAB can help keep an eye on expenses and identify areas to cut back.

- Limit Luxuries: While it’s tempting to indulge occasionally, consider the longer-term benefits of frugality. Swap out expensive habits for cost-effective alternatives.

- Avoid High-Interest Debt: Credit card debt can quickly erode your savings. Prioritize paying off high-interest loans and avoid accumulating new ones.

- Invest Wisely: Even as you save, look for low-risk investment avenues to grow your money over time. Compound interest can be a powerful ally.

Balancing Risks: The Responsibility of Using Your Own Funds

Using personal savings brings a weighty responsibility. It’s a balance of believing in one’s vision and ensuring you’re not jeopardizing your financial future. Here are some strategies to consider:

- Set Clear Boundaries: Decide beforehand how much of your savings you’re willing to invest. Having a clear cap ensures you don’t drain all your resources.

- Keep Personal and Business Finances Separate: Open a dedicated business account. This not only makes tracking expenses easier but ensures personal finances remain untouched beyond the decided investment.

- Regularly Reassess: As your business grows and evolves, regularly review your financial health. Be ready to pivot your strategy if required, always ensuring you’re not stretching your personal finances too thin.

Crowdfunding: Harnessing the Power of the Masses

In an age where connectivity is at its zenith, entrepreneurs have a unique opportunity to tap into collective financial power, turning the masses into potential backers of their vision. Crowdfunding offers a blend of community building, market testing, and financing. By presenting your idea to the world, you not only gather funds but also gain invaluable feedback and create a potential user base, all while retaining full ownership of your startup.

Platforms to Consider: Kickstarter, Indiegogo, GoFundMe

While there are numerous crowdfunding platforms available, some have risen to prominence due to their success rates, user base, and unique features. Here’s a brief overview:

- Kickstarter: Best known for creative projects ranging from tech innovations to art installations, Kickstarter operates on an all-or-nothing funding model. If your project doesn’t meet its financial goal within the stipulated time, all funds are returned to backers.

- Indiegogo: While similar to Kickstarter in many ways, Indiegogo offers more flexibility with funding models. Entrepreneurs can opt for either fixed (all-or-nothing) or flexible (receive funds regardless of goal achievement) models.

- GoFundMe: Primarily known for personal fundraising, GoFundMe has seen an increasing number of entrepreneurs raising startup capital. It’s best suited for projects with a strong personal or social angle.

Crafting a Compelling Story

At the heart of every successful crowdfunding campaign is a captivating narrative. Potential backers aren’t just investing in a product or service; they’re buying into a vision, a dream.

- Be Transparent: Share your journey, the challenges, and the reason you’re passionate about your idea.

- Engage Visually: Videos, infographics, and high-quality images can make your campaign stand out.

- Highlight the Impact: Explain not just the features but the real-world benefits or changes your product or service will bring about.

Rewards and Incentives for Backers

To entice potential supporters, most crowdfunding campaigns offer rewards [3]. These are not just tokens of appreciation but also ways to involve backers in your journey:

- Early Access: Give backers the first taste of your product or service.

- Exclusive Merchandise: T-shirts, mugs, or other branded items can foster a sense of community.

- Tiers of Involvement: Offer varying reward levels based on contribution amounts. This can range from a simple thank you note to a personalized experience with the product or team.

Successful Crowdfunding Campaign Examples

Drawing inspiration from those who’ve treaded the path can be enlightening:

- Pebble Time: A smartwatch that raised over $20 million on Kickstarter, proving the immense potential of community-backed innovation.

- Flow Hive: Revolutionizing honey harvesting, this project raised over $12 million on Indiegogo, showcasing the power of a unique idea combined with compelling storytelling.

- BauBax: Touted as the world’s best travel jacket, it tapped into a genuine consumer need and raised over $9 million, reaffirming that solving real-world problems can garner mass support.

Pre-Sales and Early-Bird Specials

For businesses with tangible products or clearly defined services, another effective bootstrap financing strategy is pre-sales. This approach is not just a means of securing funds but is also a testament to market demand. By offering products or services for sale before they are officially launched or produced, entrepreneurs can gauge interest, gather initial funds, and build anticipation.

The Concept of Pre-Sales

Before we delve into tactics, it’s essential to grasp the fundamental premise of pre-sales:

- Definition: Pre-sales involves offering products or services for purchase before they’re readily available to the general market. These are often at a discounted rate to incentivize early buyers.

- Benefits: Aside from the immediate influx of cash, pre-sales can validate market demand, provide valuable customer feedback, and help fine-tune the final product or service offering.

Crafting Attractive Early-Bird Specials

Creating a successful pre-sales campaign hinges on crafting compelling early-bird offers. These deals need to strike a balance between enticing customers and ensuring sustainability for the business:

- Discounted Rates: One of the most straightforward incentives is to offer the product or service at a reduced price for a limited time or a limited number of customers.

- Bundled Offers: Combine your primary offering with complimentary goods or services to enhance its value.

- Exclusive Features or Customizations: Provide early supporters with unique features or personalization options not available to later buyers.

Platforms and Tools to Facilitate Pre-Sales

Today, various platforms simplify the process of conducting pre-sales, ensuring a seamless experience for both the entrepreneur and the customer:

- Shopify: A popular e-commerce platform, Shopify allows sellers to list products as pre-order items easily.

- Celery: Focusing exclusively on pre-sales and crowdfunding, Celery provides tools to collect funds, manage orders, and communicate with buyers.

- WooCommerce Pre-Orders: For those using WooCommerce for their online store, this extension enables easy setup and management of pre-sale items.

Case Studies: Successful Pre-Sales Campaigns

Analyzing businesses that effectively leveraged pre-sales can provide valuable insights:

- Oculus Rift: Before being acquired by Facebook, Oculus used pre-sales to generate buzz and fund the production of their VR headsets, solidifying the market’s appetite for immersive gaming experiences.

- Coolest Cooler: Beyond crowdfunding success, this innovative cooler continued to generate revenue through pre-sales, highlighting a clear demand for a product that combined fun and functionality.

- Wyze Cam: Offering advanced tech at a fraction of competitors’ prices, Wyze utilized pre-sales to fund initial production batches, quickly establishing themselves in the smart home market.

Microloans and Peer-to-Peer Lending

As entrepreneurs explore avenues beyond traditional banking to fund their startups, the world of microloans and peer-to-peer (P2P) lending offers a beacon of hope. These methods democratize the lending process, bypassing many of the traditional barriers and allowing for a more personalized approach to obtaining funds. They’re especially useful for businesses that might not yet qualify for larger, traditional loans but require a modest capital infusion to kickstart their operations.

Microloans: Small Loans Making a Big Impact

In the realm of finance, microloans offer a unique blend of accessibility and flexibility [4].

What Are Microloans? Essentially, microloans are small loans offered to entrepreneurs to help start or grow their businesses. Typically, they’re designed for those who have difficulty obtaining financing through traditional means.

Benefits

Microloans often come with more flexible terms, lower interest rates, and can be obtained faster than traditional bank loans. They can be especially helpful for businesses in their infancy or those in underserved communities.

Providers

Numerous institutions offer microloans, from specialized microfinance institutions to nonprofits. Organizations like Kiva and Accion are notable names in this space.

Peer-to-Peer Lending: Decentralizing the Lending Process

Peer-to-peer lending shifts the dynamics of borrowing, offering a refreshing change from traditional bank-centric models:

Understanding P2P Lending

At its core, P2P lending platforms connect borrowers directly with individual lenders, removing the need for a traditional financial institution as an intermediary.

Benefits

P2P lending can often provide quicker access to funds, competitive interest rates, and a more personalized borrowing experience. For lenders, it can offer attractive returns compared to traditional investments.

Popular Platforms

Companies like LendingClub, Prosper, and Funding Circle have paved the way for P2P lending, offering platforms where both borrowers and investors can benefit.

Best Practices for Borrowers

While microloans and P2P lending can be powerful tools, it’s essential to approach them responsibly:

Understand the Terms

As with any financial commitment, it’s crucial to thoroughly understand the interest rates, repayment terms, and any potential fees involved.

Build a Solid Case

Just like seeking investment, when applying for a loan, have a detailed business plan, financial projections, and a clear explanation of how you’ll use the funds.

Prioritize Repayment

To maintain a positive credit history and build trust within the lending community, always prioritize repaying loans on time [5].

Success Stories: Real-Life Impact of Alternative Lending

To truly grasp the transformative power of microloans and P2P lending, let’s explore a few success stories:

Hand & Cloth

A social enterprise, Hand & Cloth used microloans to employ at-risk women in Bangladesh, creating artisan textiles and fostering community development.

The Honey Club

Through P2P lending, this urban beekeeping initiative secured funds to expand its operations, supporting biodiversity in urban settings and raising awareness about the importance of bees.

Sweet Beginnings

This Chicago-based startup tapped into microloans to produce honey-infused skincare products, offering employment opportunities to residents with criminal backgrounds and contributing to community rehabilitation.

Trade Equity for Services

In the expansive toolkit available to the modern entrepreneur, trading equity for services stands out as a potent, yet often overlooked, strategy. Rather than exchanging ownership for capital, startups can offer equity in return for essential services that might otherwise strain their budget. This method can facilitate the acquisition of high-quality expertise without immediate outlay, strengthening the foundation of the budding business.

The Basics of Equity for Services

To truly harness the power of this strategy, one must first grasp its fundamentals:

What Does it Mean?

Trading equity for services means that, in lieu of traditional payment, businesses offer a percentage of their company’s ownership to individuals or firms in exchange for their professional services.

Why Consider it?

For startups with limited cash flow but significant growth potential, this can be an attractive proposition to secure essential services such as legal advice, marketing, software development, and more.

The Win-Win Scenario

Service providers acquire a stake in the startup’s future success, while the startup gets the benefit of the service without the immediate financial strain.

Potential Services to Consider

While equity can be traded for a myriad of services, some are particularly prevalent and impactful:

Legal Counsel

Startups often need legal guidance for incorporation, patents, contracts, and more. Trading equity ensures they get top-tier advice without the hefty price tag.

Web Development and Tech Services

Building a robust online presence or developing software can be resource-intensive. Skilled tech professionals, in exchange for equity, can help lay a strong digital foundation.

Branding and Marketing

Establishing a brand identity and market presence is vital. Creative agencies or marketing professionals might be open to equity deals in the early stages of a promising startup.

Crafting a Fair Agreement

Navigating equity for services requires careful consideration and clear agreements:

Valuation and Equity Amount

Start with a clear valuation of your startup. Determine how much the needed service would typically cost and agree on a fair equity percentage based on that valuation [6].

Vesting Period

Rather than transferring equity immediately, consider a vesting schedule. This ensures that service providers remain committed over a specified duration.

Clear Deliverables

Just as with traditional contracts, outline specific deliverables, timelines, and expectations to prevent future disputes.

Successful Examples of Equity for Services

To cement the potential of this approach, let’s look at a few startups that successfully leveraged it:

In its early days, Instagram provided equity to a design firm for their role in developing the app’s iconic logo and interface. This decision played a crucial part in Instagram’s visually captivating brand identity.

Before its billion-dollar acquisition by Facebook, WhatsApp traded equity for legal services, ensuring the company’s legal frameworks were robust without depleting its resources.

Dropbox

To refine its user experience, Dropbox once traded equity for top-tier design expertise, resulting in a more user-friendly interface and aiding its exponential growth.

Competitions and Grants

In the quest to find alternative financing, entrepreneurs often overlook the vast world of competitions and grants. These avenues not only provide much-needed capital but also come with the added benefits of validation, networking opportunities, and increased visibility.

Startup Competitions: More Than Just Prize Money

Startup competitions have become a staple in the entrepreneurial ecosystem, and they offer a plethora of benefits:

What Are They?

These are contests where entrepreneurs pitch their business ideas or models to a panel of judges, often vying for monetary prizes, mentorship, and other resources.

Beyond the Cash Prize

While the immediate financial reward is evident, participating in such competitions can also offer validation for your business idea, invaluable feedback, and a chance to catch the eye of potential investors or partners.

Notable Competitions

Events like TechCrunch Disrupt, Startup Battlefield, and the Hult Prize have given startups a significant boost in their early stages [7].

Grants: Free Money with a Purpose

Grants are essentially funds that organizations or governments give to startups without expecting repayment. However, they come with their unique dynamics:

Understanding the Basics

Unlike loans, grants don’t need to be repaid. They are often awarded based on innovation, societal impact, or the potential to address specific challenges.

Strings Attached?

While grants are “free money,” they often come with conditions. Recipients might be required to reach certain milestones, provide regular updates, or use the funds in specific ways.

Finding the Right Fit

Various organizations, including government bodies, NGOs, and corporations, offer grants. Platforms like GrantWatch or the Small Business Innovation Research (SBIR) program can be starting points.

Tips for a Successful Application or Pitch

Securing grants or winning competitions isn’t just about having a great idea—it’s also about presenting it compellingly:

Know Your Audience

Tailor your pitch or application to resonate with the grant institution’s objectives or the competition’s theme.

Clarity and Conciseness

Whether it’s a grant proposal or a competition pitch, being clear and concise about your vision, strategy, and value proposition is essential.

Gather Data

Backing your claims with data can add credibility. Market research, pilot results, or testimonials can be particularly persuasive.

Inspiring Success Stories

Numerous startups have catapulted to success, leveraging the power of competitions and grants:

Rover

The pet-sitting platform Rover began its journey with a win at Startup Weekend in Seattle. This victory provided not only seed money but also validation and early traction.

GoldieBlox

This toy company, focused on encouraging girls to take up engineering, secured initial funding through various grants aimed at supporting innovative solutions to societal challenges.

Theranos

Before its controversial fall, Theranos, the blood-testing company, received early-stage funding from grants due to its purported groundbreaking healthcare innovations.

Leverage Assets: Home Equity and Personal Assets

Navigating the early stages of a business often requires entrepreneurs to think creatively and take calculated risks. One such avenue involves leveraging personal assets, including home equity, to secure the capital needed to launch or grow a startup. While this strategy can be potent, it is not without its complexities and risks.

Home Equity: Turning Your Home into Capital

Utilizing the value tied up in your home can be an accessible way to fund your business, but it requires careful consideration:

Understanding Home Equity

Home equity represents the current market value of your home minus any remaining mortgage payments. This value can be tapped into through various financial products.

Home Equity Loans and Lines of Credit

These options allow homeowners to borrow against their equity. Loans provide a lump sum, while lines of credit offer flexibility in drawing funds as needed.

Pros and Cons

While this approach can provide significant capital at relatively low-interest rates, it does come with risks, including potential loss of your home if repayment falters [8].

Leveraging Personal Assets: Beyond Real Estate

Other personal assets can also be strategically deployed to finance a startup:

Savings and Retirement Accounts

While not without risks, personal savings, or even retirement funds, can be invested in your business. Be sure to understand the implications for taxes and long-term financial planning.

Stocks and Investments

If you have a portfolio of stocks or other investments, you may consider selling or borrowing against these assets to raise capital.

Physical Assets

Assets like vehicles, equipment, or other valuables can either be sold or used as collateral for loans.

Essential Precautions and Best Practices

Leveraging personal assets is not a decision to be taken lightly. Here are some key considerations:

Consult Financial Experts

Speak with financial advisors or accountants to understand the potential implications for your personal financial health.

Consider the Risks

Be clear about the potential risks, including the impact on personal credit, tax considerations, and the potential loss of assets.

Create a Clear Plan

Outline how you will use the funds and your strategy for repayment or recovery of assets. Having a detailed business plan can be particularly useful here.

Real-Life Examples of Leveraging Assets

Leveraging personal assets has been a springboard for several successful entrepreneurs:

Elon Musk

He famously poured much of his personal fortune into Tesla and SpaceX, facing significant financial risk but ultimately propelling both companies to success.

Sara Blakely

The founder of Spanx leveraged her personal savings to fund the initial stages of her business, turning a $5,000 investment into a billion-dollar empire.

References

[1] What Is Bootstrapping? What It Means and How It’s Used in Investing

[2] Bootstrapping Your Startup: What to Know About Self-Funding

[3] Bootstrap Finance: The Art of Start-ups

[4] Bootstrapping or Equity Funding: Which Is Better for Your Business?

[5] 6 Sources of Bootstrap Financing

[6] Evidence of Bootstrap Financing among Small Start-Up Firms

[7] The determinants of bootstrap financing in crises

[8] Bootstrapping